Believ Ai - Transforming Banking with Conversational Intelligence

Platforms

Responsive Web,

Mobile App

Deliverables

UI, UX, Product Strategy,

Design System

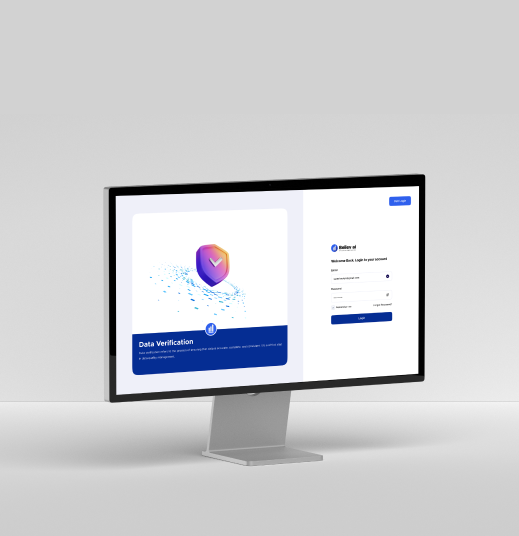

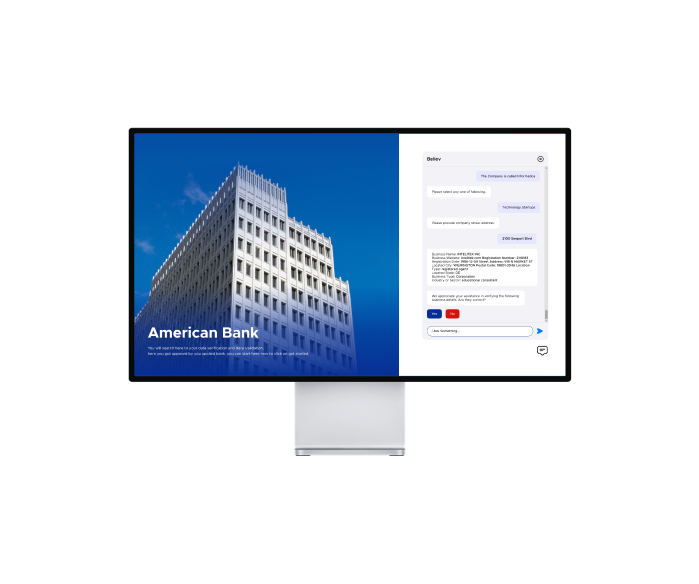

Revolutionizing Digital Verification

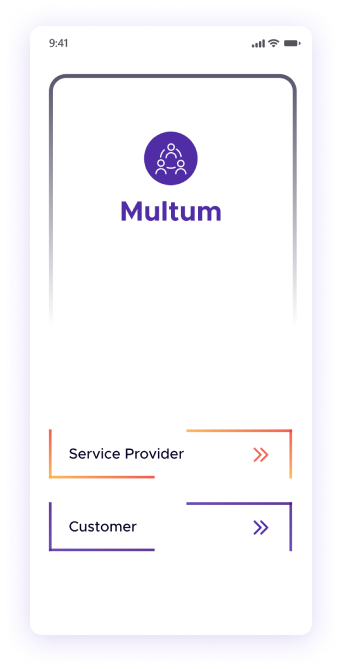

Believ AI is an innovative platform designed to enhance digital banking experiences by merging advanced Conversational AI with seamless integration across mobile and web interfaces. Easily accessible via redirection from any bank’s website, the platform provides real-time interactions and automates complex processes with unparalleled efficiency. By addressing challenges in verification and compliance, Believ AI empowers banks to deliver secure, intuitive, and user-focused solutions.

Tackling Complex Challenges

The creation of Believ AI required solving some of the toughest challenges in digital banking. Automating verification processes, such as Know Your Customer (KYC) and Know Your Business (KYB), demanded a balance of speed, accuracy, and compliance. Real-time data processing was critical to handle the vast volumes of information generated by users. Fraud detection mechanisms had to be robust and proactive to prevent breaches. Above all, user trust and confidence needed to be established through a secure, reliable, and user-friendly platform.

Designing for Simplicity and Trust

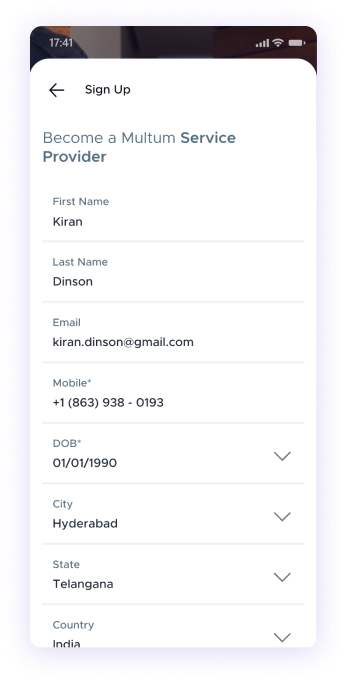

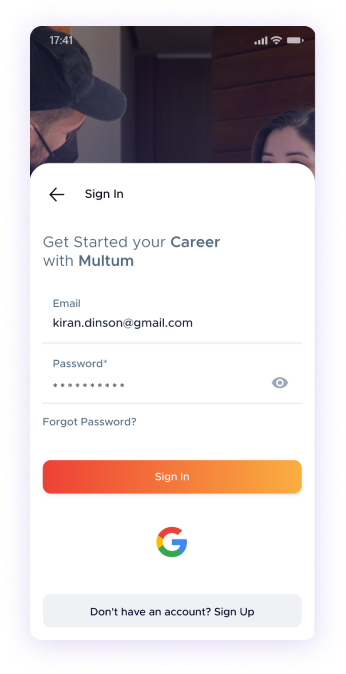

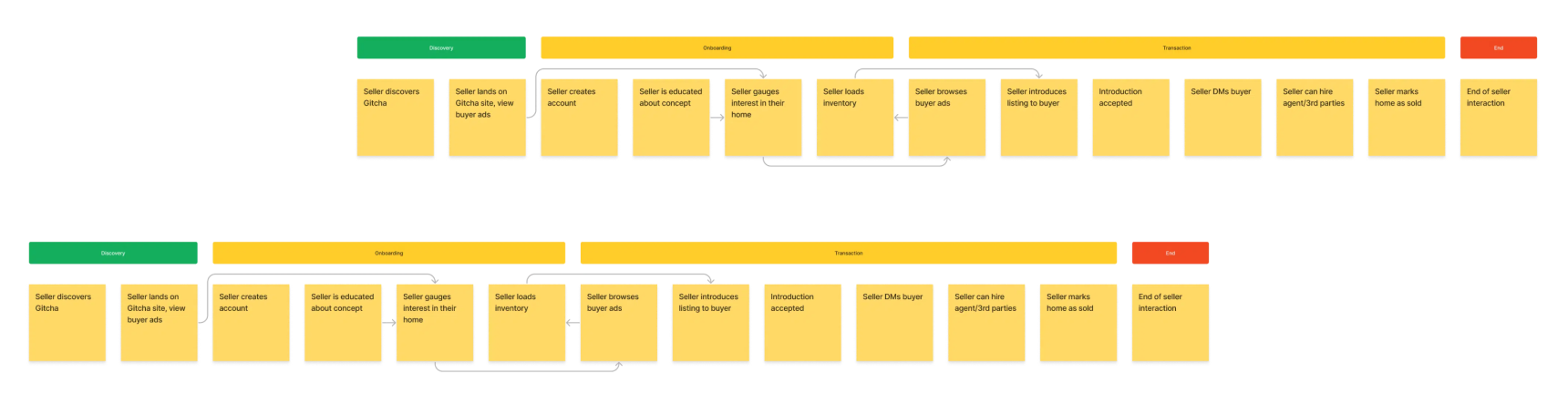

During the design phase, Believ AI focused on creating a platform that simplifies the complex nature of digital verification and banking workflows. In-depth user research revealed pain points and informed the development of a streamlined interface that ensures intuitive navigation. The design emphasized trust-centric features, such as clear data usage policies and transparent interactions, to build user confidence. By combining simplicity with functionality, the platform ensures that both tech-savvy and less experienced users can easily access its features.

The design also incorporated clear visual cues and interactive elements that guide users through processes like fraud checks and identity verification, minimizing the chances of errors while maintaining a professional and approachable interface. The result is a system where users feel supported and empowered to complete essential tasks effortlessly.

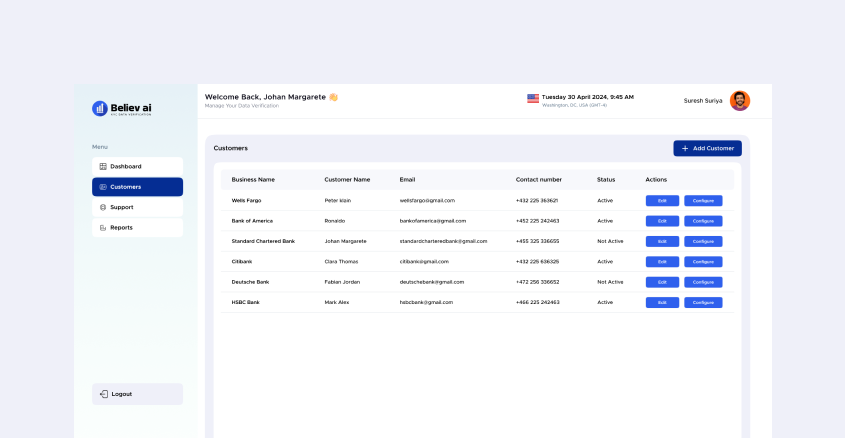

Believ AI’s design philosophy was rooted in creating a seamless and user-friendly experience, making complex banking processes accessible to all. The platform’s interface was meticulously crafted to reduce friction in workflows such as KYB and KYC verifications. Every design decision was influenced by extensive user research, ensuring the interface aligned with user needs and expectations. By employing intuitive navigation and clear call-to-action elements, Believ AI empowers users to complete critical tasks without confusion or delays.

To build trust, the platform integrated transparent data usage policies and real-time feedback mechanisms, allowing users to remain informed and confident at every step. Trust-centric features, such as secure login protocols and visible compliance certifications, further reinforced user confidence.

Engineering Scalability and Security

The development phase of Believ AI leveraged cutting-edge technology to build a platform capable of handling the demands of modern digital banking. Conversational AI was seamlessly integrated to automate real-time tasks, enabling users to interact naturally while the platform processed complex data in the background. A Node.js backend provided the scalability needed to support high-performance workflows, while PostgreSQL ensured secure, reliable data management.

Security was a cornerstone of the platform, with advanced encryption protocols and fraud detection algorithms implemented to protect user data and maintain compliance with industry regulations. These measures ensured that sensitive information was handled with the utmost care, fostering trust among users and financial institutions.

Conversational AI Integration:

Believ AI harnesses the power of Conversational AI to redefine how users interact with digital banking platforms. By using advanced natural language processing (NLP) algorithms, the system understands and responds to user queries in a conversational manner, similar to how a human would interact. This feature enables users to access services like KYB (Know Your Business), KYC (Know Your Customer), and fraud detection effortlessly, without needing to navigate complex forms or procedures.

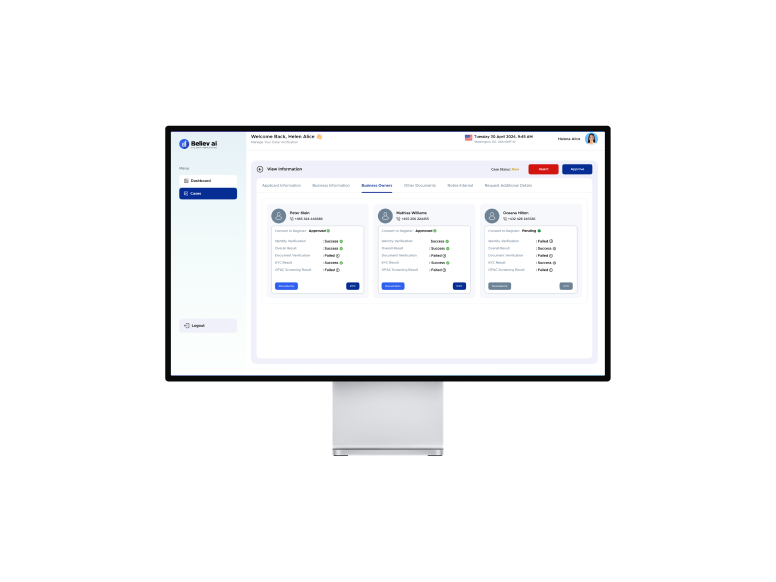

Automated Verification Processes:

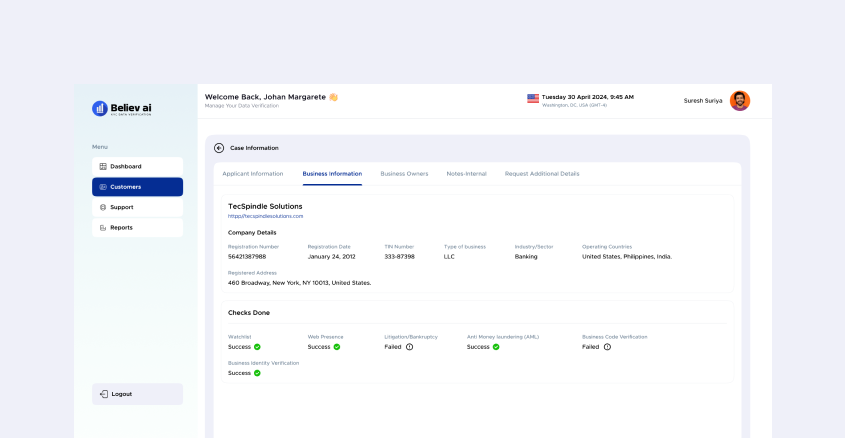

Believ AI revolutionizes the verification process by automating complex workflows and ensuring compliance with stringent regulations such as AML (Anti-Money Laundering), PEP (Politically Exposed Persons), and sanctions screening. The platform streamlines tasks by collecting essential data, such as identification documents or business registrations, and verifying their authenticity against trusted databases. For instance, during KYC (Know Your Customer), users can upload government-issued IDs, which the system scans and instantly validates using secure repositories.In addition to data validation, Believ AI conducts real-time compliance checks by cross-referencing user information with global watchlists and databases.

The development phase of Believ AI successfully combined advanced technology with robust security measures, resulting in a platform that is both scalable and secure. By integrating Conversational AI, a powerful Node.js backend, and reliable PostgreSQL databases, the solution streamlined complex banking processes while delivering exceptional performance.

Through its unwavering focus on security and compliance, Believ AI not only safeguarded user data but also established itself as a trusted partner for financial institutions. This commitment to engineering excellence ensures that the platform can adapt to evolving demands, empowering users and banks alike to navigate the digital banking landscape with confidence.

Strategic and Secure Deployment

The deployment of Believ AI followed a phased approach to ensure optimal performance and user satisfaction. Hosted on AWS, the platform benefits from a highly scalable and reliable cloud infrastructure, capable of supporting millions of users without compromising on speed or security. Automated monitoring was introduced to track compliance and detect anomalies, allowing the system to respond to potential issues in real time.

The rollout began with incremental deployment to gather user feedback and make iterative improvements. This approach not only enhanced the platform's features but also ensured that it met the expectations of diverse user groups, including individuals, businesses, and banks. The focus on reliability and security during deployment solidified Believ AI as a trusted partner in digital banking transformation.

Transformative Results

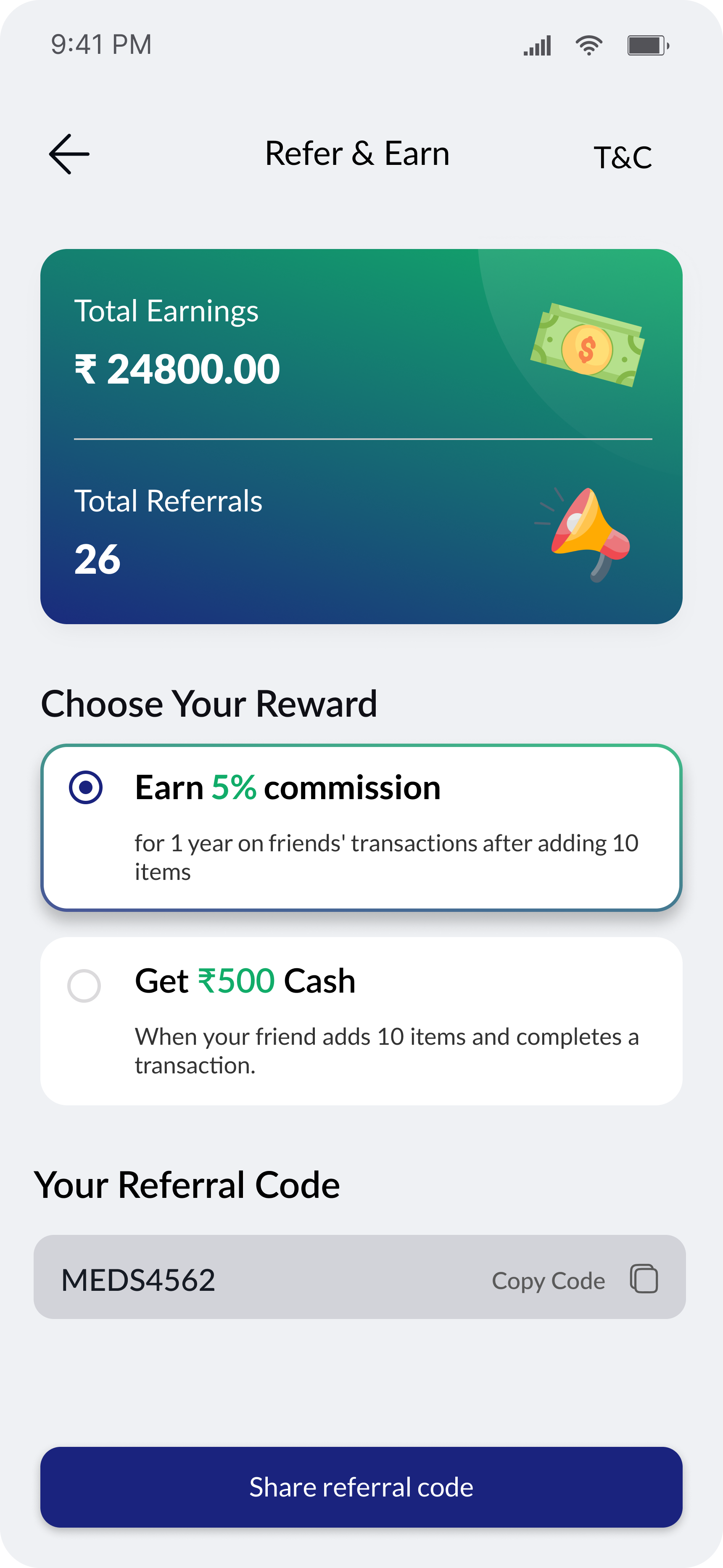

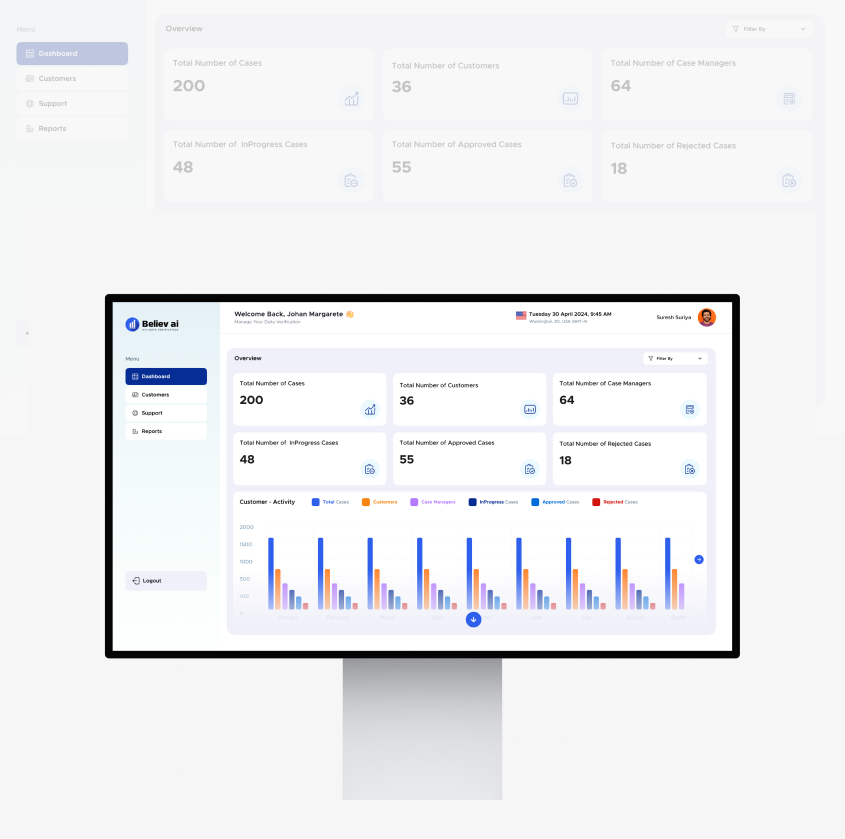

Believ AI has achieved remarkable results in addressing the challenges of modern banking. By automating KYB and KYC processes, the platform has significantly reduced manual effort and improved verification accuracy. Enhanced compliance measures, such as Anti-Money Laundering (AML) checks, Politically Exposed Persons (PEP) screening, and sanctions monitoring, have bolstered security and trust.

The platform’s intuitive workflows have driven widespread adoption by simplifying traditionally complex processes, increasing user satisfaction. Additionally, its robust architecture supports seamless integration with multiple banks, enabling the platform to handle high volumes of activity without compromising performance. Believ AI has emerged as a reliable, scalable, and future-ready solution for modern banking challenges.